|

DOI: 10.25136/2409-7136.2022.7.38520

EDN: CKLYRT

Received:

22-07-2022

Published:

29-07-2022

Abstract:

The subject of the study is the legislative and law enforcement experience of the United States in the field of using special types of trust management of property of civil servants and officials as a tool to overcome conflicts of interest in the public service. The relevance of this study is confirmed by the fact that the United States, one of the few states that uses this tool, as well as the Russian Federation. However, in our country, the legal regulation of this institution is still not perfect enough, therefore, it is important enough to study the experience of those states where there is such a practice. The work was prepared as part of the state assignment to the Financial University under the Government of the Russian Federation for 2022. The scientific novelty of the research is determined by the fact that currently there are practically no works containing an analysis of the institute in question. In the course of the study, the following conclusions were made.The most developed, from the point of view of the legal regulation of the institution of trust management of the property of civil servants, is the legal regulation in the USA, where, in addition to the legislative consolidation of the very possibility of placing their assets in a trust (as an alternative to sale), there are detailed administrative regulations for the actions of employees, including, among other things, developed forms forms of documents for each stage of the procedure. For Russian legislation, a detailed regulation of the actions of civil servants in the situation with the transfer of property to trust management also seems very reasonable, since the current reference to the norms of civil legislation obviously does not satisfy the necessary regulatory need, which leads to significant difficulties in law enforcement.

Keywords:

trust management, trust, blind trust, diversified trust, civil servant, official, conflict of interest, corruption, anti-corruption policy, public service

This article is automatically translated.

You can find original text of the article here.

One of the ways to prevent (prevent) the occurrence of a conflict of interest in the state or municipal service in the Russian Federation is the transfer of securities and some other types of property of an employee to trust management. And, of course, the transfer of certain types of property to trust management in order to prevent a conflict of private and public interests, and, accordingly, minimize corruption risks, is not a unique institution exclusively of Russian legislation. Moreover, in a number of states, the use of various options for trust management as a tool for preventing corruption has a fairly long history. Initially, "traditional" forms of trust management were used in the legislation of foreign countries to prevent and resolve conflicts of interest, as well as in our country at present, but gradually the point of view that such an approach is ineffective began to spread more widely. This is explained primarily by the fact that the "traditional" forms of trust management were originally invented to solve fundamentally different problems. The owner transfers his property to trust management when he believes that another person will manage it better than himself. Thus, the owner may lack the special knowledge necessary to manage the asset, time or desire to engage in relevant activities, etc. At the same time, when transferring assets to trust management, the owner usually reserves the right to receive information about the process and results of trust management and the condition of the relevant assets, as well as the right to give instructions to the trustee on how to deal with assets.[1] From the point of view of conflict of interest regulation, such trust management does not differ from the independent management by an official of his assets. Thus, if it is possible to use trust management to resolve a conflict of interests, then it should be about its special forms focused specifically on preventing corruption. Their most important element are restrictions that prevent an official from obtaining information about the composition of assets held in trust, making it difficult to perform actions aimed at increasing their value and profitability, as well as preventing an official from continuing to make meaningful decisions regarding problematic assets. In practice, the creation and implementation of an effective model of specialized trust management is an extremely difficult task. For this reason, examples of countries using appropriate mechanisms are very few in comparison with the total number of countries that have fixed certain norms on the regulation of conflicts of interest in their legislation. Among the countries, to a certain extent, using specialized types of trust management in preventing conflicts of interest, are, first of all, the United States. However, here it is necessary to take into account the specifics of the legal system of the American state – its significant decentralization, and keep in mind that out of all 50 states, one way or another, blind trusts are mentioned in the context of ensuring the impartiality of public servants only in the legislation of individual regions, and the number of such states has significantly decreased over the past 10 years. But, where the provisions on blind trusts have remained, Blind trusts are applied in an attempt to ethically balance private interests with the public duties of public officials or civil servants. Thus, in accordance with the Administrative Regulations of the State of Kansas (§ 19-41-1 – Definitions)[2] - "blind trust" means a trust created by a public official or a public employee, or his spouse, in order to alienate his control and awareness of financial assets that can generate a conflict of interest. In the state of Alaska, in order to qualify a trust as blind, the following conditions must be met. (AK ST § 39.50.040)[3] A trust may not contain investments or assets if the ownership or interest must be registered with a government agency other than the Alaska Public Offices Commission, or contain assets that make the transfer unlikely or impractical, including real estate, security interests in personal property, mortgages and interests in closely related companies. The trustee must be a bank, trust company or other institutional fiduciary (a person (organization) who has undertaken to act on behalf of and on behalf of another person in a particular case in circumstances that give rise to a relationship of trust). In contrast to this provision, in the Russian Federation, in accordance with paragraph 1 of Article 1015 of the Civil Code of the Russian Federation, the trustee may be an individual entrepreneur or a commercial organization, with the exception of a unitary enterprise. However, in cases where the trust management of property is carried out on the grounds provided for by law, the trustee may also be a citizen who is not an entrepreneur, or a non-profit organization, with the exception of an institution. The trustee has all the powers to manage the trust. The trust document (contract) should contain a clear statement that its purpose is to remove from the founder control and knowledge about the investment of trust assets in order to eliminate conflicts between the responsibilities of the founder as a public official and the personal (including financial) interests of the founder. To achieve this goal, during the term of the trust, the founder or other beneficiary may not contact the trustee except in writing and only regarding the following points: general financial requirements regarding the distribution of the trust as a whole;

instructions to the trustee that, since the law, or other regulatory or law enforcement act prohibits the founder from owning the asset, the asset cannot belong to the trust; instructions to the trustee to sell the entire asset originally placed in the trust, since the founder has determined that the sale is necessary to avoid a conflict of interest; the appearance of obscenity or violation of ethical norms. At the same time, on a quarterly basis, the manager may provide the founder with a written report on the total market value of the assets and property of the trust, but may not disclose to the founder or other beneficiary of the trust or any other interested party any information about the identification characteristics of any of the assets of the trust. In addition, the trustee is obliged to report any violation of the confidentiality of assets known to him. It should be noted that Russian legislation does not provide for any restrictions on communication between the principal and the trustee. The trust is terminated only by order of the Alaska Public Institutions Commission, death or incompetence of the founder, termination of the founder's status as a public official, or revocation approved in advance by the commission. The trustee is obliged to inform the commission immediately of any termination of the trust. The trustee prepares the income tax declaration of the trust and can participate in the verification of the trust declarations with the authority to challenge the tax liability of the trust, but cannot disclose the tax return or information related to the declaration, except in cases when immediately after the end of each taxable year of the trust, the trustee provides the founder with an annual report summarizing information about the trust, including net profit or loss, expenses, capital gains and capital losses of the trust, if necessary in order for the founder to prepare and file tax returns required by law, however, the summary cannot directly or indirectly identify a security or other property that is an asset or a former asset of the trust. The trustee should be instructed to avoid deliberately investing in a corporation, business or enterprise in respect of which the founder is likely to take action due to the official position of the founder. During the term of the trust, the founder or other beneficiary may not pledge or otherwise encumber the interests of a person in an asset that is part of the trust, the founder may not retain control over the trustee, and the founder is not allowed to make any recommendations or suggestions regarding the property of the trust. The trustee agreement must provide that the trustee will provide the Attorney General or the personnel board with access to any records or information related to the trust that are necessary in the investigation or hearing of an allegation of violation of the Alaska Executive Ethics Act.[4] The trustee must inform the Alaska Public Institutions Commission of the initial and final value of the trust, and, if the commission requests, the trustee must prepare a detailed description of the trust's transactions and holdings; the document prepared by the trustee under seal is not public information if the charge is in accordance with the Alaska Executive Ethics Act,[4] related to a blind trust, not filed by the Attorney General or the personnel board. The trust cannot take effect until the trust document has been submitted and approved by the Alaska Public Institutions Commission. The initial assets placed in a blind trust must be listed by the official in the application together with a description of the actual or potential conflict of interest or appearance of a conflict that the official seeks to avoid with the help of the trust. A copy of the document on the establishment of a blind trust must be attached to the application. The person initiating a written communication in accordance with this section must provide a copy of the communication to the commission within five days after the date of the communication. The trustee maintains and provides tax returns, accounting books and other records of the trust for verification by the commission at the request of the commission, and no later than May 15 of each year submits to the commission a notarized document confirming compliance with this section for the previous calendar year. Note that all of the above provisions, in accordance with the Alaska Statute (§ 39.50.200), apply only to officials and employees of the executive branch. However, the Alaska Public Institutions Commission, which has jurisdiction over the legislature, apparently requires the same disclosure of legislators' financial information. The regulation of blind trusts in the legislation of the state of Maryland is given in sufficient detail. Thus, paragraph 15-501,[5] of the Annotated Code of the State of Maryland, establishes requirements for non-participation of employees and state officials in official affairs in which they are interested or in which an economic entity participates as a party, or have certain economic relations. The Article on Public Administration (15-502) prohibits these officials and employees from having a financial interest in an organization that is subject to their authority or the agency with which they are associated, or which is negotiating a contract with the agency. Exceptions to these prohibitions are provided for persons under the jurisdiction of the State Ethics Commission, in accordance with the rules of the Commission, when it determines that there is no conflict or appearance of conflict, and when it will not contradict the purposes of the Law.

In this regard, the Code of the State of Maryland also defines the circumstances in which a certified blind trust or an excluded blind trust will be considered by the Ethics Commission as meeting the statutory criteria for exclusion from these conflict of interest provisions. The underlying concept here is that in situations where a trust is created by an independent third party or there are diversified holdings in a trust created by a government official or employee, the official or employee does not know the financial interests of the trust, and does not control these interests, which means that his official actions will not be influenced or seem influencing private interests. Thus, the general goal of public policy, achieved by relying on blind trust, is the actual "blindness" or lack of knowledge or control on the part of an official or employee in relation to their personal interests that are in trust. The administrative Regulations of the State of Maryland, in accordance with section 19a (State Ethics Commission), require that a blind trust be, firstly, well diversified (When making a decision, the Commission considers: the number of holdings; the share of the portfolio in any particular holding or industry; the value of each holding; and the percentage of ownership in the organization that the official represents a person or an employee), secondly, it is easy to sell (when assessing the marketability of holdings, the presence of a market for holdings is taken into account, including whether they are traded on a public exchange; whether prices are indicated in general circulation securities; the number of assets – for the absence of restrictions on the possibility of sale). In order for a trust to qualify for certification, the trustee must be independent and unrelated to an official or employee, both in reality and in appearance, as well as: must be a financial institution or an operating organization that, as a rule, actively participates in trust management activities; may not have an employee who is a spouse, parent, child, brother or sister of any interested party; may not have any current accounts, loans or other financial transactions with any interested party; during the period of the trust's existence, it may not make any institutional political contributions to an official or employee, as well as have any managerial employee or individual with responsibilities related to the trust actively participating in any political campaign of any interested party; may not be subject in any significant way to the current regulatory or contractual powers or control of an official or employee if the current functions of the official or employee are regulatory or contractual; and must meet the above requirements not only initially, but also in the future. In addition, it is not allowed to have executives or persons with responsibilities related to the trust who are partners, joint entrepreneurs, employees/consultants or otherwise involved in business ventures with any interested party. Again, unlike the above provisions, Russian legislation does not establish any prohibitions on the affiliation of the trustee and the principal. According to South Carolina law,[6] a blind trust is any trust in which a government official, a government member, a government employee, a candidate for elected office or a member of his family has a beneficial interest in the principal or income, and the trustee of the trust is a financial institution, lawyer, certified accountant, broker or an investment consultant who: a) is independent and not related to any interested party, so that the trustee cannot be controlled or influence the management of the trust by any interested party; b) is not and has not been an employee of any interested party or any organization associated with any interested party, and is not a partner or participant in any joint venture or other investment with any interested party; and c) is not a relative of any interested party. The trust agreement that establishes the trust in South Carolina must confirm and ensure that: 1) the trustee has the full right to manage and control, including the transfer and sale of trust assets, without consulting or notifying any interested party; 2) the trust does not contain assets, the possession of which by any interested party is prohibited by any law or regulation; 3) the tax return on the trust is drawn up by the trustee or a person appointed by him, and any information related to it is not disclosed to any interested party (except in cases when it can be used to detail the income from the trust, summed up by appropriate categories); and 4) prohibition of communication between the trustee and any interested party regarding the assets or sources of income of the trust, with the exception of amounts of monetary value or net income or loss; however, such a report should not identify any asset or holding.

A copy of the trust instrument must be submitted by a government official, civil servant or candidate for elected office to the relevant supervisory authority, together with a list of all assets or holdings transferred or to be transferred at the time of the creation of the trust instrument. The trust instrument and the list of assets must be filed when the trust is created, or before a public official, member, or employee takes up their duties, whichever happens later. An interesting feature of the regulation of blind trusts for public servants in South Carolina is that, in accordance with paragraphs 52-903 of Article 9, a public servant or a public official is not prohibited from taking actions or making decisions concerning a financial interest in a blind trust organized and managed in accordance with these regulations, provided that the Commission the Ethics Committee has in its dossier the materials required by these regulations. As already noted, over the past 10 years, the mention of blind trusts as a tool for preventing conflicts of interest in US regional legislation has significantly decreased, including because, although blind trusts provide one of the potential solutions in some states, their creation can be expensive and time-consuming. In addition, some American researchers believe that due to the specifics of the operation of blind trusts, many government employees manage to preserve their personal financial interests in the long term, while avoiding disclosure of information and the need for recusals. Some critics also argue that it is almost impossible to prevent communication between beneficiaries and trustees. Without a communication barrier, the legislator may unethically direct investments or carry out official actions in favor of trust assets, including because in some states assets held in a blind trust do not fall under certain reporting requirements and conflicts of interest, which potentially makes it difficult to prevent the emergence of an independent transaction.[7] This is the practice and problems of using blind trusts at the state level in the United States, with regard to federal legislation, which also contains relevant regulations, we note the following. The preamble of the United States Ethics in Government Act of 1978 states that the purpose of this legislation is to preserve and promote the accountability and integrity of public officials and institutions of the federal Government, as well as to strengthen the constitutional separation of powers between the three branches of government. The President, Vice-President and every official or executive officer whose position is above a certain classification are required to comply with the onerous financial disclosure and reporting requirements set out in Annex 4 to the Government Ethics Act of 1978, as amended by the Ethics Reform Act of 1989. Financial disclosure and reporting requirements also apply, in particular, to a member of Congress, a judicial official, the director of the Office of Government Ethics and any civil servant in the Presidential Administration. Federal officials are required to submit detailed personal financial statements when they are nominated or appointed to a position and annually during the term of public service of an official. The Government Ethics Act of 1978 created two types of qualified trusts: Qualified Blind Trust (QBT) and Qualified Diversified Trust (QDT), which can be used by employees to reduce real or probable conflicts of interest. The primary purpose of a qualified trust is to assign to an independent trustee and any other designated fiduciary the sole responsibility for the management of the trust and the management of the assets of the trust without the participation or knowledge of any interested party or any representative of the interested party. This responsibility includes the duty to decide when and to what extent the original assets of the trust should be sold or disposed of, and in which investments the proceeds from the sale should be reinvested. Since the requirements set out in the Law on Ethics in the Government[9] and in this part guarantee true “blindness”, employees with qualified trust cannot influence the performance of their job duties with their financial interests in trust assets. Their official actions under these circumstances should be free from accompanying problems arising from real or obvious conflicts of interest. It should be borne in mind that the disclosure regime is the antithesis of a blind system of trust without supervision. Thus, the US model classified trusts into Qualified Diversified Trust (QDT) and Qualified Blind Trust (QBT) in order to reduce supervision. A QDT is one that has a diversified portfolio of easily traded securities and is exempt from reporting requirements. QBT - with investments that do not meet the standards set for a diversified portfolio of easily traded securities, is subject to reporting requirements. A diversified trust requires the trustee to file tax returns without disclosing their contents to an official, whereas an official with a blind trust uses a summary of dividends and interest to file his own return, but does not receive any information about the actual assets. A diversified trust consists of a diversified portfolio of market securities. None of the assets originally placed in the trust can come from companies whose activities are related to the main area of responsibility of the official. As you can see, in a blind trust, an individual places assets that could otherwise create a conflict of interest in trust management ("trust"). Control over the trust and its assets is granted to an independent trustee who can buy and sell assets without the knowledge or consent of the beneficiary ("blind"). Theoretically, a civil servant with a blind trust would be immunized from potential conflicts related to assets held in the trust, since the beneficiary legislator would not know about the impact of official actions on personal financial interests.[10]

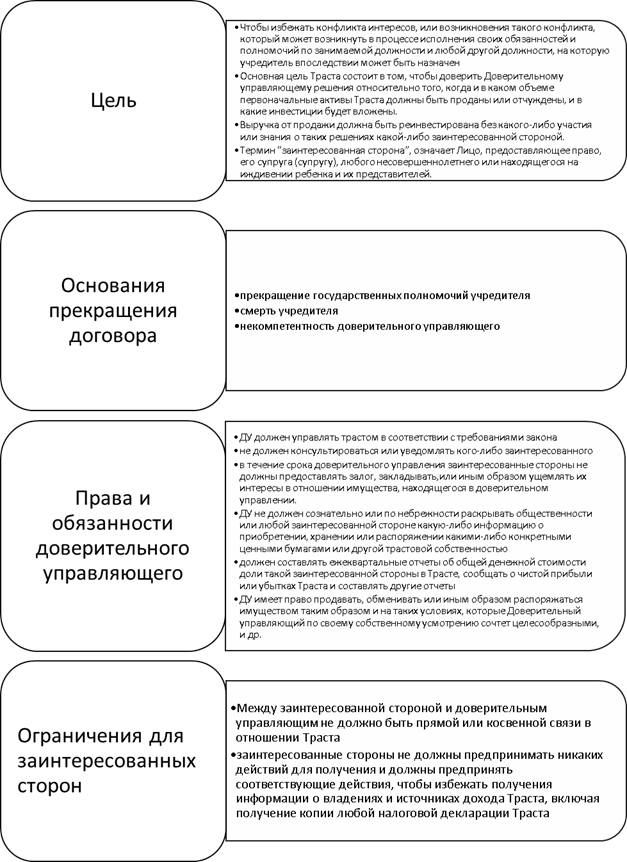

A certified blind trust is a standard method used by the U.S. government to ensure that there are no conflicts of interest between the work of an executive officer and his finances. In essence, this means that an individual transfers control over all of his assets (and in many cases, the assets of his spouse and/or children) to an independent trustee who assumes full control over their assets. The trustee then sells the assets owned by the employee and acquires new assets that the person knows nothing about. While the founder of the trust will receive updated information about how much their assets are worth, what is actually in the fund will be kept secret to avoid conflicts of interest. We believe this is an important aspect in achieving anti-corruption goals, because only when an employee does not know about the shares of which he is the owner, he will not be able to use his official position in the personal interests associated with these assets. Of course, such a provision would increase the anti-corruption effectiveness of Russian legal regulations, but, in this case, it is obvious that Russian legislation should clearly limit the subject composition of professional participants in the securities market. Recall that at the moment there is some uncertainty about who can be a trustee in Russia in this situation. Returning to the US federal legislation, we note that two key things need to be known here - an independent trustee cannot be someone with whom the founder is connected or has business relations, and must be approved by the state ethics commission. And, since what is in the trust must be kept secret, it would be illegal for this independent trustee to publish the founder's tax returns. In this case, it should be noted that Russian legislation does not provide for anything like this, although it requires an employee to transfer his securities to trust management. It should be noted that in order to clarify the procedure for establishing trusts of one kind or another, the US Office of Government Ethics has developed and published a review of the qualified trust program,[11] containing answers to questions related to the creation of a qualified trust to eliminate potential conflicts of interest. In accordance with this document, potential conflicts of interest may arise when the financial interests or affiliation of a Member of the Senate, an official or an employee can be considered as affecting the performance of official duties. For example, certain financial assets, such as stocks, may create a conflict of interest with certain aspects of working in the Senate, including voting, meetings, and actions. Although there are a number of ways to eliminate conflicts of interest and their occurrence, the most comprehensive approach is to transfer financial assets to a qualified blind trust (QBT), a special trust that is created in accordance with the guidelines established by federal law. When a QBT is created, an individual transfers asset management to an independent trustee who makes investment decisions in the interests of the individual without his knowledge. In this situation, any potential conflicts of interest are resolved because the senator, official, or employee has no knowledge of the assets, and does not control or manage them. As already noted, according to the Government Ethics Act of 1978 (EIGA)[8], as amended, the QBT must be approved by the Government Ethics Committee before its execution. In the USA, there is a sample trust management agreement provided by the Committee for use by members, officers, employees and their lawyers in drafting proposed trust management agreements to be submitted for certification (Figure 1)

Fig.1 The main elements and requirements of a trust agreement in the USA Note that many of the provisions included in the sample agreement are required by law and therefore must be included in the proposed trust agreement in order for it to be approved by the Ethics Committee. However, the wording of any particular trust always depends on the circumstances of a particular case. QBT allows grantees to avoid potential conflicts of interest or the occurrence of such conflicts during work. By transferring asset management to an independent trustee, QBT, as a rule, allows the grantor to fully invest in the market without worrying about potential conflicts of interest and the possibility of refusing to participate in official events on duty. In addition, QBT can help avoid even the appearance of a conflict of interest. However, as already noted, the creation and maintenance of a QBT is expensive and technically complex, so it may not be appropriate when other solutions are acceptable, such as the sale of a separate asset. QBTS are also not generally recommended for employees with few assets or individuals whose responsibilities are narrowly focused on a specific industry sector. Those who are "shown" the use of a qualified trust by American law, after the creation of the QBT, must submit the executed trust agreement to the relevant competent authorities within 30 days. At the same time, failure to submit the executed trust management agreement within 30 days from the date of approval by the Committee may lead to the fact that the person granting the right will have to request approval again. We believe that, according to the experience of the United States, it is also necessary to provide criteria for assessing distressed assets in Russia, as well as formally consolidate alternative options for alienation, which are not currently available. As already mentioned, the trustee must be completely independent and, in addition, approved by the Ethics Committee.

An independent trustee cannot be affiliated, associated, or controlled or influenced by anyone who has a beneficial interest in QBT. The trustee must not be a current or former investment adviser, partner, accountant, lawyer, relative or any other person in a similar position. The ideal trustee is usually a financial institution, such as a bank or a trust company. Generally, a financial institution will be considered independent if the grantor and the family of the grantor have no relationship with the proposed trustee other than savings, checking or other types of similar accounts. It is the independence of the trustee that is a key requirement of American law when creating a qualified trust for public servants. Such independence requires that the trustee and the employees of the trust are not influenced by the grantor or other interested parties in making investment decisions, and are not “related” or “affiliated” with the grantor, or are not its employee, partner or relative. Let's say a few words about the assets that are transferred by government officials and U.S. senators to trust management. As a rule, grant-givers invest publicly traded securities (stocks, bonds and mutual funds) and cash in QBT. Conversely, real estate and campaigns (shares of campaigns) owned by employees, as a rule, are not considered ideal assets for implementation in QBT, since these types of assets cannot be fully managed and controlled by a trustee, as required by law. In Russia, on the contrary, it is envisaged to transfer to trust management, including shares in the authorized capitals of organizations. However, on the issue of the possibility of concluding a trust management agreement for a share in the authorized capital of a limited liability company (respectively, a commercial organization), even within the framework of judicial interpretation, there are two diametrically opposite positions: it is possible and it is impossible. Therefore, we consider it necessary to clarify the approach to determining the list of property, based on the possibility and validity of its transfer to trust management. The purpose of creating a QBT is to avoid conflicts of interest. Consequently, the QBT requires the grantor to transfer control of its assets to an independent trustee who manages the assets in the trust without the knowledge or control of the grantor. A trustee member of the QBT has the right to sell or dispose of any assets within the trust at his discretion, unless the restriction on specific assets is explicitly approved by the Committee. The trustee, interested parties (including the grantor, members of his or her family, other beneficiaries of the trust) cannot consult or communicate with each other on asset management, trust holdings or trust management. However, the grantor is allowed to communicate preferences for maximizing income or long-term capital gains or balancing capital security with growth. For example, you can tell the trustee whether you want to be risky, moderate or conservative in your investments. Assets originally placed in QBT, as they are known to the grantor, continue to create a potential conflict of interest until they are sold or reduced to a value of less than $1,000 in accordance with US law. New assets acquired by the trustee are not disclosed to the grantor, therefore they do not create a conflict. Once the QBT is approved by the Ethics Committee, communication between the grantor and the trustee is almost completely restricted: all interested parties and the trustee are prohibited from discussing asset management, trust holdings or trust management. However, the grantor is allowed to request the allocation of funds, in addition, the grantor can receive periodic reports on the overall effectiveness of its QBT. The trustee is prohibited from consulting or communicating with the beneficiaries or other interested parties in the QBT regarding the identification of any asset in the trust, except for informing the grantor, beneficiary or other interested parties when the original asset has been sold or its value has become less than $1,000, as required by law. The trustee must prepare a tax return for the QBT; however, the grantor and interested parties cannot be provided with any reports on the QBT holdings of the party. Only information about the cost and income of QBT as a whole can be transmitted. QBT beneficiaries may not attempt to obtain information about any assets held in trust. QBT beneficiaries cannot communicate with the trustee, except for receiving the following written information from them: total financial expenses or income of interested parties; notifications of legal prohibitions on assets; an order for the sale of all initial assets that create a real or perceived conflict of interest. Summing up the analysis of the regional and federal legislation of the United States in the field of application of qualified asset trust management in order to prevent a conflict of private and public interests for government employees and some other categories of persons, the following conclusions can be drawn. Despite the fact that the transfer of property to trust management (blind trust) is provided for both at the regional and federal levels, a systematic analysis of American legislation leads to the conclusion that, after all, the preferred (and most effective) way to prevent a conflict of interest is its complete alienation by public authorities.

This conclusion is supported by the concerns of US national researchers on this issue, which boil down to three main points: firstly, the creation of a trust involves significant organizational difficulties and financial costs; secondly, it is virtually impossible to ensure the complete independence of the manager from the founder of the trust, which, accordingly, levels the result of all the efforts expended, and it does not lead to a proper anti-corruption effect; and, thirdly, the use of trust schemes significantly reduces the transparency of income and expenses of a civil servant, which does not strengthen public confidence in the authorities. Nevertheless, practice shows that a number (although not so significant) of American officials and senators have trust agreements for the management of their assets (of course, first of all, we are talking about senior government officials), therefore, it is necessary to recognize the "trust instrument" as working in preventing conflicts of interest. The specifics of the US legislation on blind trusts can be considered the following key points: the maximum possible independence of the trustee from the founder, achieved by preventing the affiliation of these persons by any criteria (kinship, business, and even personal relationships); an extremely balanced approach to the choice of the trustee – it must be approved by the Ethics Committee before the conclusion of the trust agreement, and, ideally, be a banking organization or other professional structure; specifics in determining the list of assets to be transferred to a trust – shares, cash, but not campaigns (shares in campaigns) and not real estate; selective approach to transferred assets – there is no need for transfer if the assets are not significant; selective approach to potential founders – there is no need for transfer if the functions of the employee are limited to a narrow sphere; a mandatory requirement regarding the change of the original assets included in the trust to other assets that the founder theoretically has no way to find out about. So, taking into account all of the above, we believe that no matter how the relations of our state with the American one are currently developing, nevertheless, the Russian legislator should take a closer look at the most effective provisions of legal regulation and the practice of using the institute of trust management as a way to overcome conflicts of interest in the United States.

References

1. Maskaleva O., Konov A. (2021) Trust management as a tool for preventing and resolving conflicts of interest. HSE Anti-Corruption Center /Working Materials. Issue #2 URL: https://anticor.hse.ru/assets/working_material_files/3_ru.pdf (accessed: 27.07.2022)

2. Kansas Administrative Regulations URL: https://www.law.cornell.edu/regulations/kansas (accessed: 07/27/2022)

3. Alaska Statutes / Title 39. Public Officers and Employees. 2020 URL: https://law.justia.com/codes/alaska/2020/title-15/chapter-13 / (accessed: 27.07.2022)

4. Alaska executive branch ethics act. 2003 URL: https://law.justia.com/codes/alaska/2003/title-39/chapter-39-52 / (accessed: 27.07.2022)

5. Maryland Code of Regulations / Title 19A-State Ethics Commission // URL: https://www.law.cornell.edu/regulations/maryland/COMAR-19A-06-01-01 (accessed: 27.07.2022)

6. South Carolina Code of Regulations / Article 9-Blind Trusts / URL: https://www.law.cornell.edu/regulations/south-caroli (accessed: 27.07.2022)

7. Yes, No, Maybe So | When Should a Legislator Use a Blind Trust? URL: https://www.ncsl.org/bookstore/state-legislatures-magazine/yes-no-maybe-so-legislators-and-blind-trusts.aspx (accessed: 27.07.2022)

8. Ethics in government act of 1978 // https://www.law.cornell.edu/uscode/text/5a/compiledact-95-521 (äàòà îáðàùåíèÿ: 27.07.2022)

9. Sale of property to comply with conflict-of-interest requirements URL: https://www.law.cornell.edu/uscode/text/26 (accessed: 27.07.2022)

10. Blind Trusts URL: https://www.ncsl.org/research/ethics/blind-trusts.aspx(accessed: 27.07.2022)

11. Qualified blind trusts / Select Committee On Ethics United States Senate / URL: https://www.ethics.senate.gov/public/_cache/files/286a4cf9-5aab-40ef-9a6c-bf2278e79e38/qualified-blind-trusts-guide---october-2020.pdf (accessed: 27.07.2022)

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

A REVIEW of an article on the topic "Using the trust management mechanism as a way to prevent conflicts of interest in public service: the US experience". The subject of the study. The article proposed for review is devoted to topical issues of conflict of interest prevention in the civil service. The aspects of trust management based on the US experience are considered and, accordingly, the possibilities of using this experience in Russia are discussed. The subject of the study was the opinions of scientists, the provisions of legal acts (primarily, legal acts of the United States, individual states). Research methodology. The purpose of the study is not stated directly in the article. At the same time, it can be clearly understood from the title and content of the work. The purpose can be designated as the consideration and resolution of certain problematic aspects of the issue of using the trust management mechanism as a way to prevent conflicts of interest in public service in the United States, as well as the possibility of using this experience in Russia. Based on the set goals and objectives, the author has chosen the methodological basis of the study. In particular, the author uses a set of general scientific methods of cognition: analysis, synthesis, analogy, deduction, induction, and others. In particular, the methods of analysis and synthesis made it possible to summarize and share the conclusions of various scientific approaches to the proposed topic, as well as draw specific conclusions from the materials of the practice of civil servants in the United States. The most important role was played by special legal methods. In particular, the author actively applied the formal legal method, which made it possible to analyze and interpret the norms of current legislation (first of all, the legal norms of individual US states). For example, the following conclusion of the author: "In the state of Alaska, in order to qualify a trust as blind, the following conditions must be met. (AK ST § 39.50.040)[3] A trust may not contain investments or assets if ownership or interest must be registered with a government agency other than the Alaska Public Offices Commission, or contain assets that make transfer unlikely or impractical, including real estate, security interests in personal property, mortgages and interests in closely related companies." Taking into account the purpose and topic of the study, the author actively used the comparative legal research method, which made it possible to compare legal regulation in Russia and the United States, as well as draw conclusions about the significance for our country of the experience of a number of US states. For example, the author of the article notes that "according to the experience of the United States, in Russia it is also necessary to provide criteria for evaluating distressed assets, as well as formally consolidate alternative options for alienation, which currently do not exist. As already noted, the trustee must be completely independent and, in addition, approved by the Ethics Committee. An independent trustee cannot be affiliated, associated, or controlled or influenced by anyone who has a beneficial interest in QBT. The trustee must not be a current or former investment advisor, partner, accountant, lawyer, relative, or any other person in a similar position. The ideal trustee is usually a financial institution such as a bank or a trust company." Thus, the methodology chosen by the author is fully adequate to the purpose of the study, allows you to study all aspects of the topic in its entirety. Relevance. The relevance of the stated issues is beyond doubt. There are both theoretical and practical aspects of the significance of the proposed topic. From the point of view of theory, the topic of preventing conflicts of interest in public service is complex and ambiguous. To understand and resolve it, it is necessary to study a large number of regulatory sources, take into account psychological and other important aspects of a civil servant's activity. Studying foreign experience is one of the ways to solve such problems. From the point of view of practice, proposals for improving domestic legal regulation and creating more effective Russian legislation in the field of public service could be important and necessary. The practical examples given by the author in the article clearly demonstrate this issue. Thus, scientific research in the proposed field should only be welcomed. Scientific novelty. The scientific novelty of the proposed article is beyond doubt. Firstly, it is expressed in the author's specific conclusions. Among them, for example, is the following conclusion: "Summing up the analysis of regional and federal US legislation in the field of qualified asset trust management in order to prevent conflicts of private and public interests for government employees and some other categories of persons, the following conclusions can be drawn. Despite the fact that the transfer of property to trust management (blind trust) is provided for both at the regional and federal levels, a systematic analysis of American legislation leads to the conclusion that, after all, the preferred (and most effective) way to prevent a conflict of interest is its complete alienation by public authorities. This conclusion is supported by the concerns of US national researchers on this issue, which boil down to three main points: firstly, the creation of a trust is associated with significant organizational difficulties and financial costs; secondly, it is virtually impossible to ensure the complete independence of the manager from the founder of the trust, which, accordingly, levels the result of all the efforts expended, and it does not lead to a proper anti-corruption effect; and, thirdly, the use of trust schemes significantly reduces the transparency of income and expenses of a civil servant, which does not strengthen public confidence in the government. Nevertheless, practice shows that a number (although not so significant) of American officials and senators have trust agreements for managing their assets (of course, first of all, we are talking about senior government officials), therefore, it is necessary to recognize the "trust instrument" as a worker in preventing conflicts of interest." These and other theoretical conclusions can be used in further scientific research. Secondly, the author suggests ideas for improving the current Russian legislation and practice in the field of public service regulation. In particular, "taking into account all of the above, we believe that no matter how our state's relations with the American one are currently developing, nevertheless, the Russian legislator should look at the most effective provisions of legal regulation and practice of applying the institute of trust management as a way to overcome conflicts of interest in the United States." The above conclusion may be relevant and useful for law-making activities. Thus, the materials of the article may be of particular interest to the scientific community in terms of contributing to the development of science. Style, structure, content. The subject of the article corresponds to the specialization of the journal "Legal Studies", as it is devoted to legal problems related to the regulation of relations in the field of public service. The content of the article fully corresponds to the title, as the author considered the stated problems and achieved the research goal. The quality of the presentation of the study and its results should be recognized as fully positive. The subject, objectives, methodology and main results of the study follow directly from the text of the article. The design of the work generally meets the requirements for this kind of work. No significant violations of these requirements were found. Bibliography.

The quality of the literature used should be evaluated poorly. The author actually used only one scientific work: Maskaleva O., Konov A. Trust management as a tool for preventing and resolving conflicts of interest. HSE Anti-Corruption Center /Working Materials. Issue #2 URL: https://anticor.hse.ru/assets/working_material_files/3_ru.pdf (date of reference: (07/27/2022) At the same time, not a single work by authors from the United States in English is given, which seems unreasonable given the comparative legal orientation of the study. In this format, the work becomes somewhat similar to a descriptive work (description of legislation), which is not allowed for a scientific style. Although, given the originality of a number of the author's conclusions, such an opinion (about the exceptional descriptive nature of the article) should be considered inconsistent. Thus, the works of the above authors correspond to the research topic, but do not have a sign of sufficiency, do not contribute to the disclosure of various aspects of the topic. Appeal to opponents. The author has not conducted a serious analysis of the current state of the problem under study, as indicated above. The scientific part of the work (links to Russian and American researchers) should be expanded. Conclusions, the interest of the readership. The conclusions are fully logical, as they are obtained using a generally accepted methodology. The article may be of interest to the readership in terms of the systematic positions of the author in relation to the stated problems in the case of expanding the bibliography. In general, the article can be published despite several comments. Based on the above, summing up all the positive and negative sides of the article, "I recommend publishing"

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Eng

Eng